Here are three tips to share with your policyholders.

Sharing these tips with your policyholders will assist you and the policyholder should there be a loss.

1. What jewelry should be insured?

It’s not always about the monetary value; if a piece has sentimental value, consider insuring it. Ask yourself:

- Would I be devastated by loss of the piece?

- Am I afraid to wear a piece because of fear of theft or loss?

- Would I be unable to afford the cost to replace it?

2. How often should jewelry be appraised?

You may think that if you get your jewelry appraised immediately after purchase you are set for life. However, appraisals are only valid for a limited period of time.

The reasons jewelry needs to be appraised every few years include:

- Jewelry markets can be volatile and prices for certain stones change from year to year. You will want to have up to date information.

- As the inflation rate changes the values of your jewelry may change. Again, up-to-date information is necessary especially for insurance purposes.

Any damage to your jewelry may impact the value. If you are passing jewelry on to beneficiaries and want to divide equitably you will want to verify the condition has not changed.

The Insurance Institute of American recommends that you have your jewelry appraisal updated every two years. If you are insuring your jewelry you will want to check your specific insurance policy to find out how often they require appraisals. It is unlikely they will provide you with an appraisal reminder, so you need to keep track yourself.

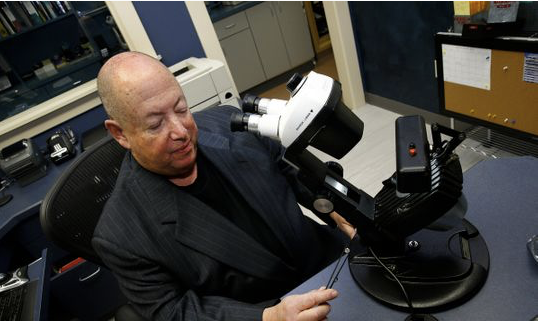

3. Where do I get my jewelry appraised?

Do your homework. Make certain that you are using a reputable appraiser with certification for appraisals. If you have a jeweler you trust, ask for recommendations and then do your own checking of the person’s appraisal credentials.